In today’s fast-paced digital world, businesses are constantly seeking ways to streamline their operations and stay ahead of the competition. One area that’s seen significant innovation is financial transactions, particularly in the realm of Electronic Data Interchange (EDI).

At the forefront of this revolution is Nwedi EDI Payments Flex, a game-changing solution that’s transforming how companies handle their payments and data exchange. Let’s dive into how this powerful tool is leading the way in streamlining business across America.

Demystifying EDI Payments: The Backbone of Modern Business Transactions

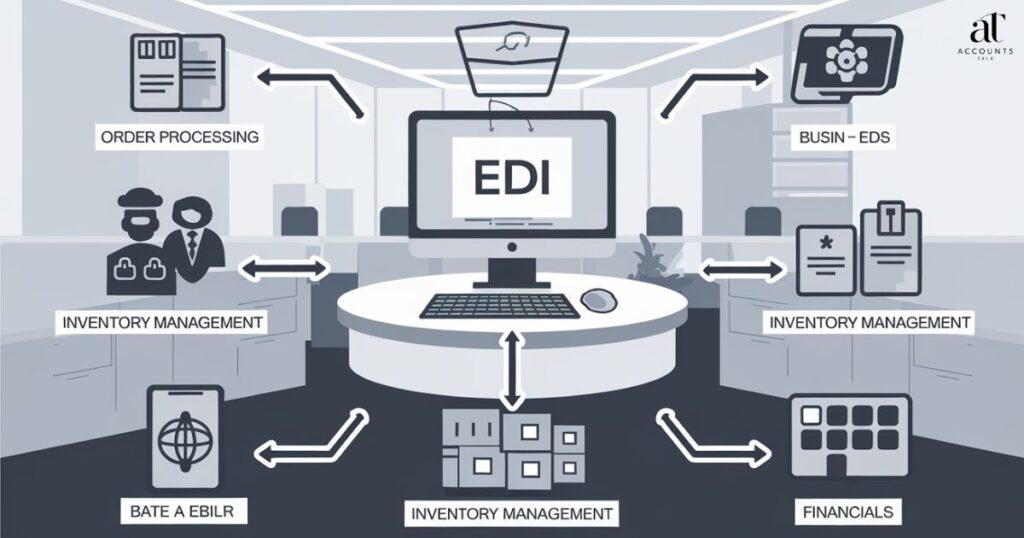

Electronic Data Interchange (EDI) has become the lifeblood of modern business transactions. But what exactly is EDI, and why does it matter so much in today’s digital environment?

EDI is a standardized method for exchanging business documents electronically between companies. Instead of relying on paper-based processes or manual data entry, EDI allows businesses to send and receive information like purchase orders, invoices, and shipping notices automatically and securely.

The evolution of business payments has been dramatic:

- Paper checks and manual invoicing

- Electronic bank transfers

- Credit card payments

- EDI payments

- Advanced EDI solutions like Nwedi EDI Payments Flex

In our fast-paced business world, EDI matters more than ever. It’s not just about speed – though that’s certainly a factor. EDI also brings:

- Improved accuracy: Reducing human error in data entry

- Cost savings: Cutting down on paper, postage, and manual processing

- Enhanced security: Implementing robust encryption and authentication measures

- Better cash flow management: Speeding up payment cycles

- Increased efficiency: Automating repetitive tasks

As one finance manager put it, “Switching to EDI payments was like going from a horse-drawn carriage to a sports car. We didn’t realize how much time we were wasting until we made the switch.“

The Historical Context of EDI

To truly appreciate the impact of Nwedi EDI Payments Flex, it’s worth taking a brief look at the history of EDI. The concept of EDI dates back to the 1960s when the transportation industry began exploring ways to standardize information exchange. By the 1980s, EDI had spread to other sectors, becoming a crucial tool for large corporations.

However, early EDI systems were complex and expensive, often requiring dedicated hardware and specialized knowledge to operate. This limited their adoption to larger enterprises with substantial resources. As technology advanced, EDI became more accessible, but it still lacked the flexibility and user-friendliness that modern businesses demand.

This is where solutions like Nwedi EDI Payments Flex come in, bridging the gap between the robust capabilities of traditional EDI and the need for agile, user-friendly systems in today’s business landscape.

More Post: What is LH Trading Atlanta GA? Decoding the Mystery on Your Bank Statement

Nwedi EDI Payments Flex: A Major Player in the EDI Arena

Enter Nwedi, a company that’s quickly become a major player in the EDI arena with its innovative Nwedi EDI Payments Flex solution. Founded in 2015, Nwedi set out with a clear mission: to revolutionize business transactions through cutting-edge technology and user-friendly design.

Nwedi’s unique approach to EDI payments sets it apart from traditional providers:

- AI-powered processing: Leveraging machine learning for smarter, faster transactions

- Blockchain integration: Enhancing security and transparency

- Mobile-first design: Enabling on-the-go management for busy professionals

- Customizable workflows: Adapting to each business’s unique needs

These features have propelled Nwedi to the forefront of the EDI market in the USA. In just a few short years, they’ve seen exponential growth, with a 200% increase in clients year-over-year since 2018.

The Nwedi Difference: Innovation Meets Usability

What sets Nwedi apart is not just its advanced technology, but its focus on usability. Many EDI solutions are powerful but complex, requiring extensive training and IT support. Nwedi EDI Payments Flex, on the other hand, is designed with the end-user in mind.

The platform’s intuitive interface allows even non-technical users to navigate complex EDI processes with ease. This democratization of EDI technology has opened up new possibilities for small and medium-sized businesses that previously found EDI adoption challenging.

As Sarah Johnson, CEO of a mid-sized retail chain, explains: “Before Nwedi, EDI seemed like something only the big players could afford. Now, we’re processing orders and payments as efficiently as any major corporation, but without the hefty IT overhead.”

Discovering Nwedi EDI Payments Flex

So what makes Nwedi EDI Payments Flex so special? Let’s break down its core features and capabilities:

- Real-time processing: Transactions are handled instantly, improving cash flow

- Advanced security protocols: Multi-factor authentication and end-to-end encryption

- API integration: Seamless connection with existing business systems

- Intelligent analytics: Providing actionable insights from transaction data

- Multi-currency support: Facilitating international transactions with ease

Here’s a step-by-step look at how Nwedi EDI Payments Flex works:

- Initiation: A business transaction is triggered (e.g., a purchase order is placed)

- Data conversion: The system automatically converts the data into the appropriate EDI format

- Transmission: The EDI document is securely sent to the recipient

- Validation: AI-powered checks ensure the data is accurate and complete

- Processing: The recipient’s system automatically processes the document

- Confirmation: A receipt is sent back to the sender

- Analysis: Transaction data is stored and analyzed for future insights

One of Nwedi’s standout features is its ease of integration. Whether you’re using SAP, Oracle, or a custom ERP system, Nwedi EDI Payments Flex is designed to plug in seamlessly, minimizing disruption to your existing workflows.

Deep Dive: The AI Advantage

The AI capabilities of Nwedi EDI Payments Flex deserve a closer look. Unlike traditional EDI systems that rely on static rules, Nwedi’s AI adapts and learns from each transaction. This means:

- Predictive error correction: The system can anticipate and prevent common errors before they occur

- Anomaly detection: Unusual patterns that might indicate fraud are flagged automatically

- Intelligent routing: Transactions are directed through the most efficient channels based on real-time conditions

- Continuous optimization: The system constantly refines its processes for peak performance

This AI-driven approach not only improves accuracy and efficiency but also provides businesses with valuable insights into their transaction patterns and financial flows.

Nwedi EDI Payments Flex vs. Traditional Forms of Payment through EDI

To truly appreciate the value of Nwedi EDI Payments Flex, let’s compare it to traditional EDI payment methods:

| Feature | Traditional EDI | Nwedi EDI Payments Flex |

| Processing speed | 24-48 hours | Real-time |

| Security | Basic encryption | AI-powered fraud detection, blockchain verification |

| Customization | Limited | Fully customizable workflows |

| Mobile access | Often limited | Full mobile compatibility |

| Analytics | Basic reporting | Advanced AI-driven insights |

| International support | Often requires additional setup | Built-in multi-currency support |

| User interface | Complex, requires training | Intuitive, user-friendly design |

| Scalability | Can be challenging | Easily scales with business growth |

| Integration | Often requires significant IT resources | Seamless API integration |

| Cost structure | High upfront costs, ongoing maintenance fees | Flexible, scalable pricing model |

When it comes to cost, Nwedi EDI Payments Flex often proves more economical in the long run. While traditional EDI systems can have high upfront costs and ongoing maintenance fees, Nwedi offers a flexible pricing model that scales with your business.

The Hidden Costs of Traditional EDI

It’s worth noting that the true cost of traditional EDI systems often goes beyond the sticker price. Consider these hidden expenses:

- Training costs: Staff often require extensive training to use complex EDI systems

- IT support: Many traditional systems need dedicated IT personnel for maintenance

- Opportunity cost: Slower processing times can impact cash flow and business agility

- Error-related expenses: Manual processes in traditional systems can lead to costly mistakes

Nwedi EDI Payments Flex addresses these issues head-on, offering a more comprehensive and cost-effective solution for modern businesses.

Implementation of Nwedi EDI Payments Flex

Implementing a new payment system might sound daunting, but Nwedi has streamlined the process to get you up and running quickly:

- Initial consultation: Nwedi experts assess your current systems and needs

- Customization: The platform is tailored to your specific requirements

- Integration: Nwedi EDI Payments Flex is connected to your existing systems

- Testing: Rigorous testing ensures everything works smoothly

- Training: Your team receives comprehensive training on the new system

- Go-live: The system is activated, with ongoing support from Nwedi

Nwedi provides robust support throughout the implementation process and beyond, with 24/7 customer service and regular system updates.

Case Study: XYZ Manufacturing

XYZ Manufacturing, a mid-sized company in the Midwest, implemented Nwedi EDI Payments Flex in 2022. Within six months, they saw:

- 30% reduction in payment processing times

- 50% decrease in payment errors

- 20% improvement in cash flow management

- $100,000 annual savings in administrative costs

Their CFO stated, “Nwedi EDI Payments Flex has transformed our financial operations. We’re more efficient, more accurate, and better positioned to grow our business.“

Overcoming Implementation Challenges

While the implementation process is designed to be smooth, it’s natural for businesses to encounter some challenges. Here’s how Nwedi addresses common concerns:

- Data migration: Nwedi provides specialized tools and expert assistance to ensure seamless transfer of historical data

- Employee adoption: The intuitive interface minimizes learning curves, and Nwedi offers comprehensive training programs

- System compatibility: With flexible API integration, Nwedi EDI Payments Flex can adapt to a wide range of existing systems

- Regulatory compliance: The platform is regularly updated to meet changing regulations across industries

The Changing World of EDI Payment

The EDI landscape is constantly evolving, and Nwedi is at the forefront of these changes. Current trends in EDI technology include:

- Increased use of AI and machine learning: Enhancing accuracy and fraud detection

- Cloud-based solutions: Offering greater flexibility and scalability

- IoT integration: Connecting physical devices to EDI systems for real-time data exchange

- Blockchain adoption: Improving security and traceability of transactions

- APIs and microservices: Enabling more flexible and modular EDI architectures

- Real-time EDI: Moving beyond batch processing to instant transactions

- Enhanced data analytics: Providing deeper insights into business operations

Nwedi is actively adapting to these trends, with ongoing development in AI capabilities, cloud infrastructure, and blockchain integration. They’re also exploring partnerships with IoT providers to expand their service offerings.

The Role of Blockchain in EDI’s Future

Blockchain technology deserves special mention in the context of EDI’s evolution. Nwedi EDI Payments Flex is leveraging blockchain to address some of EDI’s longstanding challenges:

- Enhanced security: Blockchain’s distributed ledger technology makes it extremely difficult to tamper with transaction records

- Improved traceability: Every transaction is recorded in an immutable chain, providing a clear audit trail

- Smart contracts: Automating complex multi-party transactions with self-executing contracts

- Reduced intermediaries: Direct peer-to-peer transactions can streamline processes and reduce costs

While blockchain integration is still in its early stages, it represents a significant leap forward in EDI technology, and Nwedi is leading the charge in bringing these benefits to businesses of all sizes.

Looking ahead, experts predict that EDI will become even more central to business operations. As one industry analyst put it, “In the next decade, EDI won’t just be a tool for payments and documents – it’ll be the nervous system of global commerce.“

A Bright Future for Nwedi EDI Payments Flex

Nwedi isn’t resting on its laurels. The company has ambitious plans for the future, including:

- Enhanced AI capabilities: More advanced predictive analytics and automated decision-making

- Expanded international support: Adding more currencies and country-specific EDI standards

- Improved user interface: Making the system even more intuitive and user-friendly

- Blockchain-based smart contracts: Automating complex multi-party transactions

- Advanced mobile capabilities: Bringing full EDI functionality to smartphones and tablets

- Deeper ERP integrations: Streamlining connections with popular enterprise systems

- Industry-specific solutions: Tailored features for sectors like healthcare, retail, and manufacturing

Nwedi is also expanding its presence in the US market, with new offices planned in tech hubs like Austin and Boston. They’re forging partnerships with major financial institutions and ERP providers to create a more connected EDI ecosystem.

The Road Ahead: Nwedi’s Vision for EDI

Looking further into the future, Nwedi envisions a world where EDI is not just a business tool, but a driver of innovation and growth. Some of their long-term goals include:

- Autonomous EDI: Systems that can self-optimize and adapt to changing business needs without human intervention

- Cross-industry standardization: Promoting universal EDI standards to facilitate seamless transactions across different sectors

- EDI-driven business intelligence: Using EDI data to provide deep insights into market trends and business opportunities

- Global EDI network: Creating a worldwide, blockchain-based EDI infrastructure for instant, secure transactions anywhere

As John Smith, Nwedi’s Chief Innovation Officer, explains: “We’re not just improving EDI – we’re reimagining what’s possible in business transactions. Our goal is to make complex, global commerce as simple and secure as a handshake.“

The Benefits of EDI Payments – Flex and Adopting New Technology

Embracing Nwedi EDI Payments Flex and similar advanced EDI technologies offers numerous benefits:

- Increased accuracy: AI-powered validation dramatically reduces errors

- Time savings: Automation cuts processing time from days to minutes

- Cost reduction: Less manual processing means lower administrative costs

- Improved cash flow: Faster payments and better forecasting

- Enhanced security: Advanced encryption and fraud detection protect your transactions

- Better decision-making: Rich analytics provide valuable business insights

- Scalability: Easily handle increasing transaction volumes as your business grows

- Competitive advantage: Stay ahead with the latest in payment technology

- Improved supplier relationships: Faster, more accurate payments lead to better business partnerships

- Environmental impact: Reduced paper use and lower carbon footprint from decreased manual processing

As businesses continue to digitize, solutions like Nwedi EDI Payments Flex will become not just beneficial, but essential for staying competitive in the global marketplace.

Overcoming Adoption Hurdles

Despite the clear benefits, some businesses hesitate to adopt new EDI technologies. Common concerns include:

- Cost of implementation: While there is an initial investment, the long-term savings often outweigh the costs

- Disruption to existing processes: Nwedi’s phased implementation approach minimizes disruption

- Security concerns: Advanced encryption and blockchain integration actually enhance security

- Employee resistance: User-friendly interfaces and comprehensive training ease the transition

By addressing these concerns head-on, Nwedi is helping businesses of all sizes embrace the future of EDI.

FAQs

Q: What is EDI payment flex?

EDI payment flex, as exemplified by Nwedi EDI Payments Flex, is an advanced form of Electronic Data Interchange payment system that offers flexible, customizable solutions for businesses. It typically includes features like real-time processing, AI-powered analytics, and seamless integration with existing systems.

Q: What does EDI mean for payment?

In the context of payments, EDI (Electronic Data Interchange) refers to the electronic exchange of payment-related documents like invoices, purchase orders, and remittance advice. EDI payments allow for automated, standardized transactions between businesses, reducing manual processing and improving efficiency.

Q: What are the benefits of EDI payments?

EDI payments offer numerous benefits, including:

- Faster transaction processing

- Reduced errors and improved accuracy

- Lower administrative costs

- Better cash flow management

- Enhanced security

- Improved data analytics and reporting

- Easier compliance with industry standards

Q: What are nationwide EDI payments on bank statements?

Nationwide EDI payments on bank statements typically refer to electronic payments processed through a national EDI network. These could be payments made or received using systems like Nwedi EDI Payments Flex, which facilitate secure, standardized transactions across the country.

Q: How does Nwedi EDI Payments Flex ensure security?

Nwedi EDI Payments Flex employs multiple layers of security, including:

- End-to-end encryption of all data

- Multi-factor authentication for user access

- AI-powered fraud detection algorithms

- Blockchain technology for transaction verification

- Regular security audits and updates

Q: Can small businesses benefit from Nwedi EDI Payments Flex?

Absolutely. While EDI was once primarily used by large corporations, Nwedi EDI Payments Flex is designed to be accessible and beneficial for businesses of all sizes. Its scalable pricing model, user-friendly interface, and minimal IT requirements make it an excellent choice for small and medium-sized enterprises looking to streamline their payment processes.

Q: How does Nwedi EDI Payments Flex handle international transactions?

Nwedi EDI Payments Flex is built with global commerce in mind. It supports multiple currencies, adheres to international EDI standards, and can handle country-specific payment regulations. The platform’s AI capabilities also help navigate the complexities of international transactions, such as currency conversions and compliance with various financial regulations.

The Impact of Nwedi EDI Payments Flex Across Industries

While Nwedi EDI Payments Flex offers benefits to businesses across the board, its impact is particularly pronounced in certain industries. Let’s explore how this innovative solution is transforming operations in various sectors:

Retail and E-commerce

In the fast-paced world of retail, efficient payment processing can make or break a business. Nwedi EDI Payments Flex helps retailers by:

- Speeding up order-to-cash cycles

- Improving inventory management through real-time data exchange

- Enhancing customer satisfaction with faster, more accurate transactions

- Facilitating omnichannel sales with integrated payment processing

As Maria Rodriguez, CTO of a major online retailer, notes: “Nwedi EDI Payments Flex has allowed us to process orders 50% faster. In e-commerce, that speed translates directly to customer satisfaction and repeat business.“

Manufacturing

For manufacturers, streamlined supply chain operations are crucial. Nwedi EDI Payments Flex contributes by:

- Automating purchase orders and invoices with suppliers

- Improving cash flow forecasting with real-time transaction data

- Reducing errors in complex, multi-tier supply chains

- Enabling just-in-time inventory management

Healthcare

In the healthcare industry, where accuracy and compliance are paramount, Nwedi EDI Payments Flex offers:

- Streamlined billing processes for healthcare providers

- Improved accuracy in claims processing for insurance companies

- Enhanced patient data security through advanced encryption

- Easier compliance with healthcare-specific regulations like HIPAA

Financial Services

Banks and financial institutions can leverage Nwedi EDI Payments Flex to:

- Offer enhanced EDI services to their business clients

- Improve fraud detection through AI-powered analytics

- Streamline interbank transactions

- Facilitate faster, more secure international payments

The Future of Business Transactions: Beyond EDI

As we look to the future, it’s clear that solutions like Nwedi EDI Payments Flex are just the beginning of a broader transformation in business transactions. Here are some trends we can expect to see in the coming years:

- Internet of Things (IoT) Integration: Smart devices will increasingly initiate and process transactions automatically, further streamlining supply chains and operations.

- Artificial Intelligence and Machine Learning: AI will play an even larger role, not just in processing transactions but in predicting business needs and optimizing financial operations.

- Quantum Computing: As quantum computers become more accessible, they could revolutionize encryption and processing speeds for EDI systems.

- Augmented Reality in Finance: AR could provide new ways to visualize and interact with financial data and transactions.

- Voice-Activated EDI: Natural language processing could allow for voice-controlled EDI operations, making the technology even more accessible.

Nwedi is actively researching and developing capabilities in these areas, ensuring that Nwedi EDI Payments Flex remains at the cutting edge of financial technology.

Embracing the EDI Revolution with Nwedi

As we’ve explored throughout this article, Nwedi EDI Payments Flex is more than just a payment processing system – it’s a gateway to the future of business transactions. By combining the robust capabilities of EDI with cutting-edge technologies like AI, blockchain, and cloud computing, Nwedi is empowering businesses of all sizes to operate more efficiently, securely, and profitably.

The benefits of adopting this advanced EDI solution are clear:

- Dramatically improved efficiency in payment processing

- Enhanced security and fraud prevention

- Better cash flow management and financial forecasting

- Valuable business insights through advanced analytics

- Improved relationships with suppliers and customers

- Increased competitiveness in a rapidly digitalizing business landscape

As we move further into the digital age, solutions like Nwedi EDI Payments Flex will undoubtedly play a crucial role in shaping the future of business transactions. Companies that embrace this technology now will be well-positioned to thrive in the increasingly fast-paced and interconnected global economy.

The question for businesses today is not whether to adopt advanced EDI solutions, but how quickly they can implement them to stay ahead of the curve. With Nwedi EDI Payments Flex, the future of streamlined, intelligent business transactions is not just a possibility – it’s here now, ready to transform your operations and drive your business forward.

In the words of Nwedi’s CEO, “We’re not just changing how businesses handle payments – we’re reimagining the very fabric of commerce. With Nwedi EDI Payments Flex, we’re giving businesses the tools they need to thrive in the digital age and beyond.“

As you consider the future of your business’s financial operations, remember that the power of Nwedi EDI Payments Flex is more than just technology – it’s a partnership that can help propel your business to new heights of efficiency, security, and success. The EDI revolution is here, and with Nwedi, you’re ready to lead the way.

More Post:

Mia Hazel is a finance expert and the author behind insightful content that simplifies complex financial concepts. With a passion for empowering readers to make informed financial decisions, Mia breaks down everything from budgeting to investments with clarity and precision.

Her work is dedicated to helping individuals navigate the financial world with confidence and achieve their financial goals. Follow her for practical tips and advice on all things finance.